Garren Work, MBA

VP, Mergers & Acquisitions Advisor for Businesses <$100MM

Click here to view original article

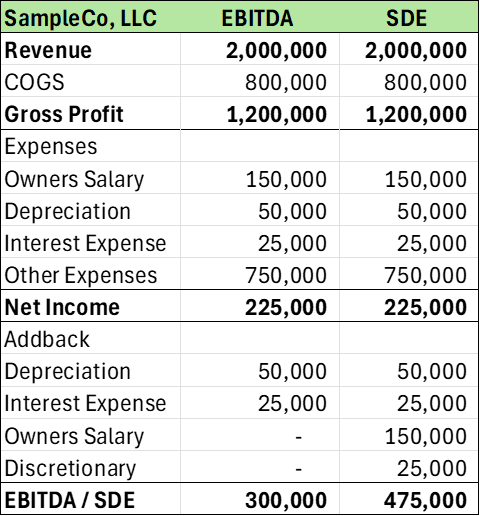

EBITDA (ee-bit-dah) thrown around like it's the only number that matters. If you’re an Owner or Dealmaker working with sub-$1Million EBITDA businesses – especially where the owner maintains a day-to-day role – you should also be familiar with the term SDE.

Let’s break down what each one means, when it's used, and how it's calculated.

EBITDA: The Professional Buyer’s Profit Number

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It’s a cleaner version of net income that removes non-operational factors to give buyers a clearer view of the business’s operating performance.

SDE: The Owner-Operator’s Profit Number

SDE stands for Seller’s Discretionary Earnings. It’s basically EBITDA, plus the owner’s total benefit from the business—salary, perks, and any personal expenses run through the business.

In plain terms?

EBITDA shows how much money the business makes before any debt payments, tax bills, or non-cash accounting charges like depreciation. It’s a normalized metric that reflects pre-tax, pre-debt cashflow is available to the owner.

SDE shows how much total value an owner-operator should expect to earn. Sometimes called Owner Benefit.

How do you know which one to use?

Size, Owner’s involvement, and Buyer Profile

Size - A $1M EBITDA is a common dividing line. Below that: use SDE. Above that: use EBITDA.

Owner’s involvement – If the owner is still working full-time in the business, SDE might be appropriate. If not, EBITDA is likely the preferred metric.

Buyer Profile – The buyer profile is really the biggest driver in determining which metric to use.

- Owner-Operator – typically SDE

- Financial – typically EBITDA

- Strategic – depends on what they can absorb or need to replace

Example:

- Bill owns SampleCo, LLC

- Bill pays himself $150,000 salary

- SampleCo, LLC also pays for Bill’s personal vehicle, family health insurance, and cell phone totaling $25,000 per year

The size is well under $1M profit, so likely SDE.

The owner is involved in the day-to-day, paying himself $150,000 salary, so likely SDE

If the Buyer is an Owner-Operator, you’d want to use SDE.

Final Thought

“Profit” isn’t just one number. It depends on the story behind the business – who is running the business, how much is discretionary, and who’s buying it.

Every Dealmaker should know the difference between EBITDA and SDE. Knowing when and how to use it is a great first step towards maximizing any exit.