Garren Work, MBA

VP, Mergers & Acquisitions Advisor for Businesses <$100MM

Click here to view original article

Selling your business is one of the most significant decisions you’ll ever make - likely the largest financial decision of your life and possibly one of the final major decisions. Beyond the numbers, it’s about your legacy, your employees, and your customers. Most importantly, selling your business is a deeply personal decision. It represents your identity, career, and the foundation of your family’s lifestyle and security.

While every business owner will eventually face an exit, preparing ensures it happens on your terms. Early preparation is key to establishing leverage going into any dealmaking process, helping to ensure a smooth transition and maximizing the value of your hard work.

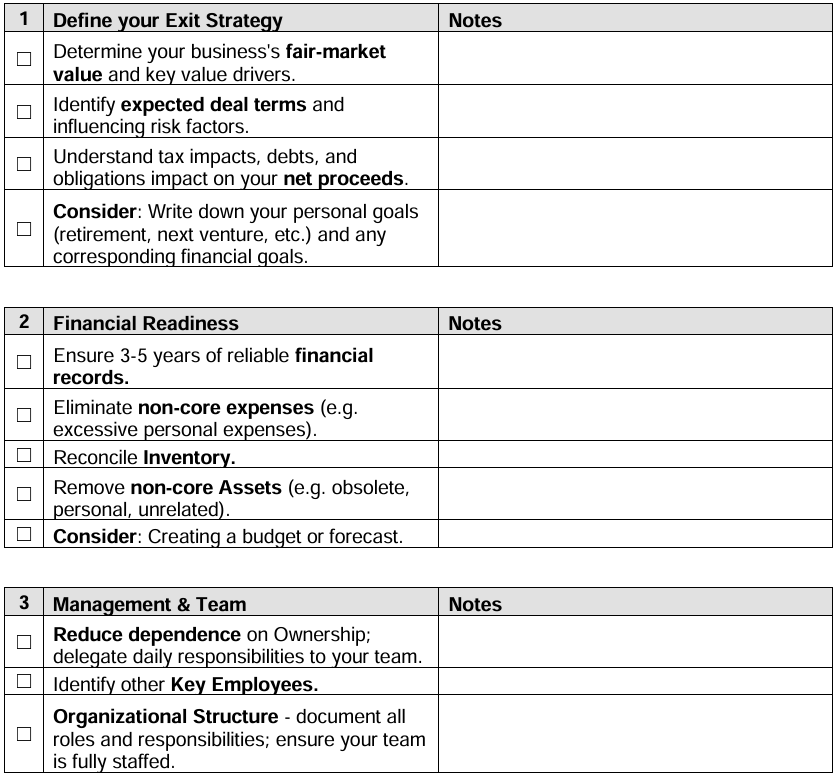

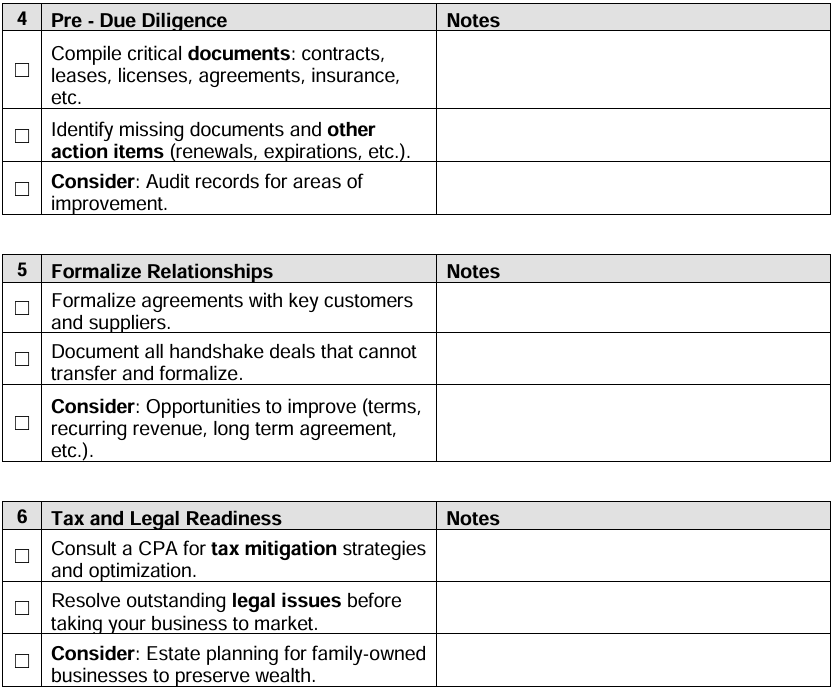

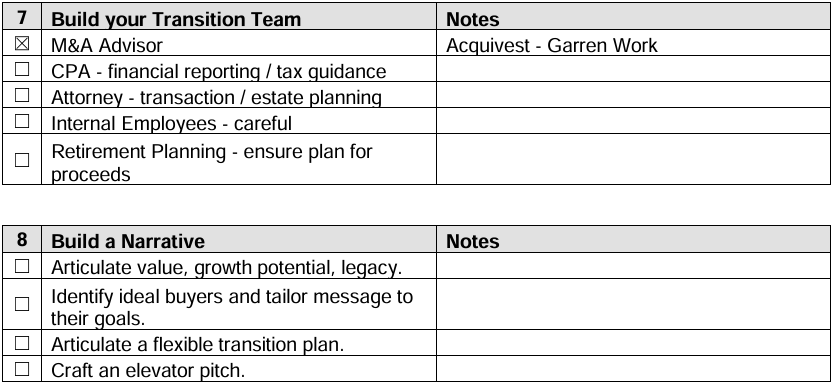

This checklist is designed to guide you in preparing your business for an exit. From refining your financials to building a strong team and creating a compelling growth story, these actions will set you up for success and attract the right buyers.

Preparing for an exit is a journey that demands strategy, foresight, and deliberate action. By addressing the key areas outlined in this checklist, you’ll set your business up for key leverage heading into the dealmaking process leading to a successful sale and maximize its value.

How far in advance should I start preparing my Exit Strategy?

Starting early ensures you have the time, energy, and motivation to make meaningful improvements, identify and address challenges, and ensure your goals align with the market. Planning less than 2 years out may create challenges in the dealmaking process and typically fail to attract top dollar. You don’t want to get caught in a situation where you’re rushed. Severe challenges can lead to a fire sale, which require just as much or even more work. Maybe sadder is watching a business slowly decline over time.

Earlier action (3-5+ years out) can allow ample time for action, typically leading to a smoother process and in the end. In the Venture Capital world, exit strategies are established right at the beginning and a major part of a business plan – while not standard practice in the LMM, maybe it should be considered.

The best exits don’t happen by chance - they’re the result of thoughtful preparation, deliberate action, and the right team supporting you every step of the way.