Garren Work, MBA

VP, Mergers & Acquisitions Advisor for Businesses <$100MM

Click here to view original article

Just as individuals aim for homeownership, business owners often benefit from owning their real estate. Property ownership provides control, stability, and financial upside—building equity instead of paying rent. When selling, owners can offer to lease the property for passive income or bundle it with the business for a higher total exit value.

Relationship Between Lease and Business Valuation

Owners who lease their property to their business often set rent below market rates. This inflates business profits on paper, due to the artificially low rent. Most Dealmakers value businesses based on EBITDA (profit), failing to adjust for this can create misleading expectations.

If the goal is Top Dollar, why make any adjustment?

An inflated valuation based on low rent won’t hold up in due diligence. Buyers will expect to continue at the below-market rate—either through a long-term lease or by purchasing the real estate. When the numbers are adjusted, the business value typically drops.

The real estate value would be understated because its income (rent) is lower than the market rate. Since real estate is often valued based on rental income (cap rate method), the property would appear to generate lower returns, reducing its appraised value.

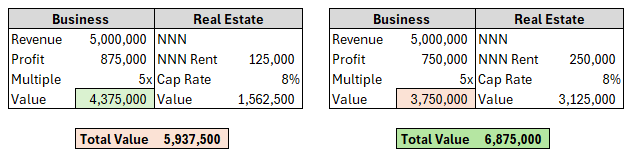

Real estate cash flow is typically valued more favorably than business cash flow. For example:

- A business with a 5x EBITDA multiple loses $5 in value for every $1 of adjusted profit.

- A property valued at an 8% cap rate gains $12.50 in value for that same $1 of rental income.

Shifting value to real estate, up to fair market rent, maximizes total exit value. The adjustment is limited to market rent because no reasonable buyer is expected to agree to pay above-market rates, who hypothetically could find a better lease and move. In reality, it likely sour the business deal, distracting from the primary focus of the business transaction.

How to Adjust for a Below-Market Lease

To get an accurate business valuation, you need to adjust the financials as if the business were paying market rent. The steps:

- Determine market rent for the property.

- Adjust EBITDA by subtracting the difference between the current rent and market rent.

- Recalculate business value using the adjusted EBITDA and valuation multiple.

Impact on Valuation

- Before adjustment: The business looks more profitable and would be overvalued. The real estate looks less profitable and would be undervalued.

- After adjustment: The business shows its true economic performance, leading to a more realistic valuation, lower than before. The real estate shows its true economic performance, leading to a more realistic valuation, higher than before.

- Total Value: The value of business + real estate increased overall, since each dollar of cashflow shifted towards the real estate is more valuable than cashflow removed from the business.

Key Takeaway

Not adjusting for below-market rent inflates the business value and deflates the real estate value. To maximize total value, consider raising the lease to market rates before a sale or ensuring adjustments are properly reflected in valuation.

Seller preference to keep or lease?

Each potential buyer will view real estate differently - some see it as risk and refuse, others as opportunity and required. To maximize value, Dealmakers should stay flexible and open-minded on a to lease or sell.

However, a seller may have a preference: either keeping the property and leasing it long-term or selling both the business and real estate together. The offering lease rate or price can be adjusted slightly to account for this preference.

Dealmakers who understand this relationship and address it early and fairly are far more likely to get a deal through to the finish line. Smart Dealmakers address this early, setting themselves up for smoother negotiation and a more profitable exit. If you wait, expect the buyer to bring it up in due diligence, possibly in ways that don’t favor the Owner or the deal.